It’s no secret that Australian motorists love their vehicles. What’s more, as a nation, we’re partial to the use of debt to leverage our assets and fund our shopping habits! However, many new car buyers only focus on the initial price of their purchase and often take for granted the ongoing costs associated with a car loan.

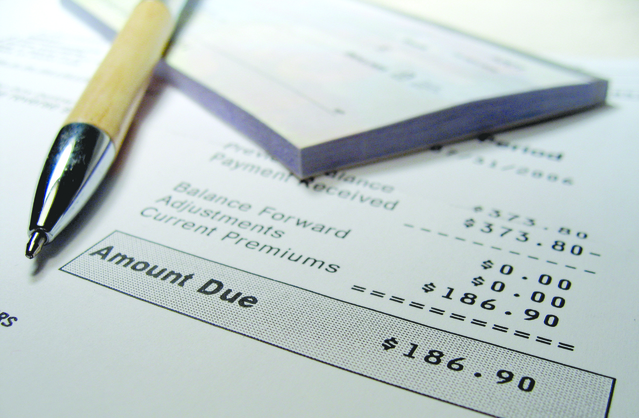

These ongoing car loan costs can accumulate over the course of your financing term. They may even end up being a lot more than you expected. Therefore, it’s important you understand the composition of such expenses. That means you will sometimes need to look past the interest rate and focus on the bigger picture, down the track.

This is not to say that the interest rate is not the most important factor – because, generally speaking, it is. On the other hand, ongoing costs can have a profound impact on the true cost of paying off your loan and should always be carefully examined before you agree to financing.

Late payment fees

Where you fail to meet the deadline of your repayments you will be charged by the lender for late payment. These costs can be quite significant and in many respects, are a punitive fee for not fulfilling your obligations under the car loan.

Repeat instances of late payment, referred to as being in arrears, can also give rise to the bank repossessing the vehicle. As a result, you must ensure that you are making your payments in full and on time.

Early termination fees

Some financiers will penalize you for paying off your loan earlier than the term of the contract. This is a stipulation that is designed to offset some of the lost interest that a lender would have been entitled to under the full length of the contract.

Account maintenance and statement fees

These fees are more common than you might think. They are intended to cover the expenses involved in managing your account, generally on a monthly basis. Although each lender will charge their own fee to provide this service, across the term of your loan the costs can add up quickly. Meanwhile, statement fees are the costs imposed on a loan recipient when you opt to have statements sent to you in the mail.

Establishment, origination and refinancing fees

Origination and establishment fees are those which are charged by a financier when you want to establish a new loan. The costs are designed to cover the lender’s administrative work in processing the documents and setting up a line of finance. Similarly, if you seek to refinance your existing loan through your current financier, you may be liable for refinancing fees, which also cover administrative efforts.

The Fincar team is here to help you with all your financing needs. Contact us today to help arrange your next car or equipment loan.