What is it – in brief.

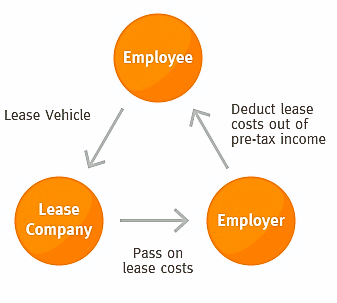

A novated lease is a tax effective vehicle finance structure that means that much of the running costs of a car can be paid for by an employee, pre-tax. There may be some fringe benefit tax (FBT) liability but in general almost every worker will be much better off than just getting a private car loan.

Watch our simple video below for more

It’s a 3-way agreement – the employer agrees to make the payments to the finance company on behalf of the employee. The employee is the legal owner of the car.

For Employees. How do I get started?

Find out if your employer is prepared to offer a novated lease. Refer them to this section so they can understand their responsibilities. If it’s a firm no, you’re stuck – without their agreement you can’t proceed. Otherwise read on…

Decide whether you’re looking to novated a brand-new car, a used car or your existing car. Most people choose the former (and bank the cash from selling their current car) but it can work in any case.

Establish whether your employer has an exclusive agreement with a novated lease provider or not. If so, then, unfortunately, you have no option but to go with that provider. This lack of competition (they have a captive market) means you’ll likely pay much higher interest rates and fees and suffer from average customer service. However, it should still work out in your favour 🤞. Otherwise, read on…

If you’re free to choose your provider then we, at Fincar, would love to assist. You’ll be introduced directly to a qualified Australian consultant who can answer all your questions and provide an indicative quote.

If the numbers look right, then next job is to get a price on a vehicle. Thankfully, this is where we can help as well. Due to our group buying power, we can get you a much bigger discount from the dealer than you’d get direct. Through a novated lease you’ll also save on the GST

Then we’ll do what we do best. We’ll shop around the lenders for the best novated interest rates and lodge the finance application. We’ll sort out the payroll with your employer and conservatively calculate budgets for your running costs. We’ll finalise negotiations with the car dealer and line up your new car!

For Employers

As an employer, making salary packaging and novated leasing available to your employees may sound like an unnecessary burden with little benefit to the business.

However, these days with the right technology and novated leasing partner, this needn’t be an onerous process and, in fact, is one of the very best ways to add value to your employee’s package.

As an employer, you will be responsible for making regular repayments from your employees pre-tax salary to cover their car ownership costs while they are working for you. This includes running costs and the lease repayments to the finance company.

Thankfully this is a one-time set up. Once the vehicle has been selected, finance approved and the running costs estimated, these payments can be automatically set up through your payroll.

As the employer you will be liable to Fringe Benefit Tax (FBT) but this can be mitigated through monthly post-tax contributions from the employee (see the next section for more details)

The biggest benefit for the employer is being able to offer a huge financial incentive to your employees at zero financial cost and negligible effort. Typically, an employee may enjoy an extra $3,000-$5,000 in their pocket each year compared to regular car finance. Plus there’s no payroll tax liability on this extra ‘pay-rise’ the driver enjoys.

It’s also a great show of commitment between both parties. On termination of the employment, the liability for finance payments falls back to the driver so an employee entering into such an arrangement is proving their dedication to the company. This also means there’s zero risk for the employer.

Fringe Benefit Tax (FBT)

A brand-new vehicle, privately owned and used, financed and paid for with pre-tax dollars and all the running costs coming out before tax is applied sounds like a dream come true.

However, there is a by-product that must been considered – Fringe Benefit Tax or FBT.

FBT is payable in theory for any private benefit that an employee may receive through their employment. The principle is that you would pay tax on any financial pay-rise received so an equivalent duty should be paid for non-financial goods of services.

For example, if an employer provides food or entertainment outside of working hours for an employee where the purpose is unrelated. It’s a complicated area (recommend visiting the ATO website for the latest guidance) but motoring and vehicle expenses often fall into this area especially through novated leasing.

First point to make about FBT is that it’s not calculated on the regular tax year (1st July to 30th June) but instead is worked off benefits offered between 1st April and 31st March. Why? This is to give time for employers to report their employees FBT position prior to the end of the financial year.

Now, how to calculate FBT on a novated lease? This is where it gets a little complicated. So read on, or skip to the next section if you feel it’s enough to know it’s likely payable and will be included in the overall cost-benefit analysis when a quote is prepared.

Statutory Method

This is where most people sit – if you drive a car that’s primarily for private use. It’s also much simpler than the Operating Costs Method (see below).

The FBT payable using the statutory method is equivalent to 20% of the vehicle’s base cost (price less on-road costs such as stamp duty and rego). This is paid using post-tax employee contributions which will also be set up at the time of entering into the agreement.

Operating Cost Method

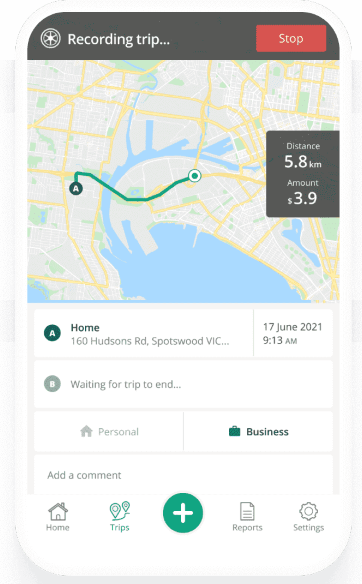

Also known as the ‘logbook method’ because… you guessed it.., it necessitates keeping a logbook to record trips and the purpose of the driving –whether it is personal or work related. The main difference is that it’s based on the cost to own & drive the vehicle (operating costs) rather than the value of the car

It is much more of a hassle than the statutory method although technology has made it easier over recent years – there are apps available that make it easier to register trips, rather than the old-fashioned pen and paper logbook.

This is rarely the preferred option for a novated lease – unless you drive the vehicle more than 50% for work purposes, it’s not recommended.

GST Free Purchase and Running Costs

Boom! Pay 10% less for your new car than everybody else! Why? Well the dealer will charge GST as usual, and the leasing company will pay the dealership however they are then able to claim that GST back with the tax office as an input tax credit.

Not only that, if running costs are incorporated into a fully maintained novated lease, the payments can also be made on the amount less GST. And yes, this includes fuel – you’ll save 10% at the pump every time you fill up your car!

So this is another distinct savings benefit of considering a novated lease (and, yes, this applies for used cars too if sold via a dealership).

Brand New Car, Used Car or My Existing Car

The vast majority of employees choose to purchase a brand new or demo car when setting up a novated lease for the first time. This is the easiest way to do it as you’re financing a car with no unknown history and a full new car warranty over the term. Reliability and ‘no surprises’ suit the novated lease budgeting model perfectly. Plus, the tax savings and the fleet discount when purchasing often make buying a new car financially viable for the first time.

However, the concept still works with a second hand or pre-owned car. However, the car must be bought from a licensed motor dealer who can provide an invoice for the finance company. So this effectively rules out the private market. However, if you see a used vehicle for sale at a car dealership and it ticks all the boxes, then go for it!

A few people even manage to set up their existing car under a novated lease. What you would need to do is sell your car to a dealer and then buy it back under the novated lease structure. You’d have to ensure that any finance owing previously is paid out in full. Fincar can help walk you through your options here.

Disadvantages

On the face of it a novated lease can look like an extremely compelling proposition and, in purely financial terms it usually is (certainly compared to most other forms of financing).

However, it pays to consider the disadvantages when deciding whether it’s worth it

Do you really need a car or to upgrade your existing car? It’s easy to get dazzled by the ‘affordability’ and the savings but remember the cheapest motoring option is generally an old reliable workhorse or even no car at all.

You carry the liability should your employment end. Often this isn’t a problem – if you quit to take on a new position at a new employer, that employer will likely allow you to carry the arrangement through. However, if you lose your job and are unemployed, say, then you’ll have to make the repayments regardless. Of course, this is the case from day one for a regular car loan but should also be kept in mind for a novated lease.

If your employer has an exclusive agreement with a salary packaging provider, there may not be much competition in terms of interest rate, management fees or even customer service. Ideally, it’s best to use providers such as Fincar who have access to multiple lenders to compare.

Other Benefits of a Novated Lease

One important aspect is the streamlining of the payments. Under traditional car ownership (with or without finance), while you may have regular lease repayments, rego time, new tyres, annual insurance premiums etc will all pop up throughout the year.

With a novated lease, all this is taken car of in your initial budget so there’s one set monthly fee deducted from your pre-tax salary. Any surplus is yours to keep.

Aside from the financial savings through paying pre-tax, and the financial savings through not paying GST, Fincar can also use their buying power to negotiate fleet discounts on the purchase price AND have negotiated special volume deals on some of the ancillary products like tyres and insurance. Again, these savings will be itemised in your quote.

Novated Lease Calculator

There’s a lot of info on this page but what most people are keen to see is how the figures actually stack up. Everything sounds great but in a real-life situation, how much money can I save?

The below calculator should help give you a basic estimate but please recognise that there are a LOT of assumptions with below. We highly, highly recommend getting in touch with the Fincar team and getting a personalised quote. Bang up to date interest rates, petrol prices & running costs combined with your particular situation mean we can give you an accurate calculation in minutes.

QUICK NOVATED LEASE SAVINGS CALCULATOR

annual saving compared to a conventional car lease with the same interest rate and Residual value.

Assumptions: Term is for 36 months, 100% personal use and statutory method used for FBT at a fixed 20%. Income excludes super and is based on current tax brackets. Vehicle price excludes GST and on-road costs. 30c/km in fuel costs. $2,000/year in annual maintenance (servicing, tyres etc). $1,000/year in insurance.

If you have any questions at all or would like a quick quote to see how the number stack up in your situation, either submit a request or give us a call on 1300 346 227 .