Buying a car can be immensely stressful and that’s understandable. Brands, models, prices, features, body types, performance attributes, amenities – plus so much more.

Not unexpectedly, how to pay for your car is one of the biggest contributors to that stress. Sure, there are loans or those hoping to win the lotto, but there is also the option of novated leasing for those that have an employer that provides a work vehicle.

The Basics of a Novated Lease

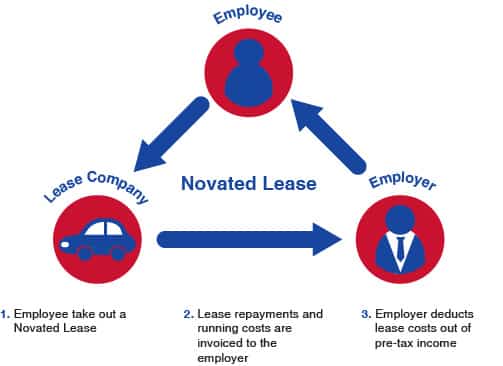

Essentially it works as a three way agreement. There’s you. There’s the employer. There’s the financier.

You decide on a vehicle, be it new or used. You specify a time you’d like to lease a vehicle for, generally from one to five years. Think of it as a long term lay-by. The employer pays for the car on your behalf, in essence, by deducting a certain amount from your wages before tax is taken out (also known as salary packaging) and sends that, on your behalf, to whomever the finance company is.

The Benefits of a Novated Lease

This means that you get some benefits. You don’t miss a payment which could happen if you looked after the finance side. By having that payment made before your tax is deducted, it also lowers the real amount per year that you get paid by your employer.

This, potentially, could put you into a pay bracket where less tax is taken and therefore “raises” your disposable income. Also, your employer is then responsible for the lease obligations of the vehicle, freeing you up for less worry as that payment covers normal costs such as rego, tyres, insurance, and more.

One of the things you don’t need to worry about is paying for the GST. That immediately puts 10% of the “purchase price” back in your pocket. Even better, you DON’T need an upfront deposit and you can choose to change vehicles whilst in the lease period. Another potential saving is if the employer attracts volume discounts, helping to lower the costs.

.

What Happens at the End of a Novated Lease?

At the end of that lease term you can then choose to: keep the car and purchase it for the amount left over (the residual) after all lease payments have concluded. At the beginning of the lease a specified price for the vehicle would have been agreed upon and your payments may have added up to a bit short of that agreed price.

The leftover, the residual, is what you can then pay to buy the vehicle. Then you can sell the car, if you choose and if you make a profit, that’s yours. Tax free. Naturally you’re also free to refinance and stay with that vehicle OR you can choose to move to another vehicle.

What Else do I Need to Know?

As one might expect with cars and money, there’s some fine print.

Should your employment be terminated before the end of the lease, you take on all of the responsibility, exactly as if you’d bought the vehicle privately. Also, there’s three types of novated leasing. There’s novated finance leasing, where you pay only for the car. A fully maintained lease is when all of the costs, as described previously, are covered. And then there is the fully-maintained novated operating lease, where the lease provider also takes on the responsibility of the residual.

FBT, Fringe Benefits Tax, is also payable, however, this is best discussed with a financier for your specific situation.

The Fincar team is here to help you with all your financing needs. Contact us today to help arrange your next car or equipment loan.