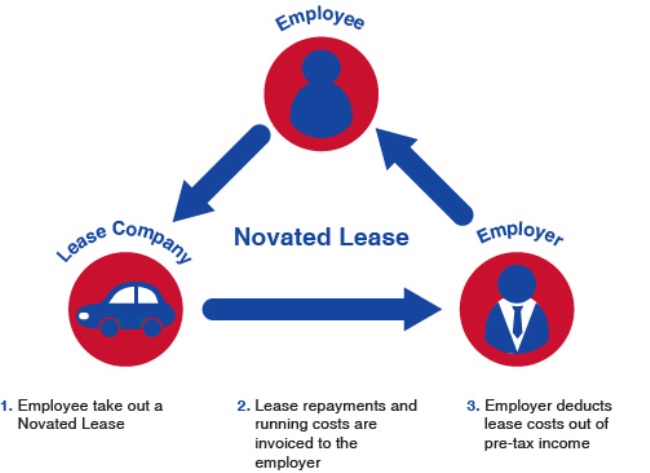

A novated lease is an agreement between your employer, a finance company and yourself.

When you choose the car you want, you then enter into a finance agreement in your own name. After that, all three parties, including your employer and the financier, sign a novated lease. Some lease companies will allow an employee to “finance” their existing vehicle or a pre-owned vehicle, but the general take-away remains the same in that you choose the car you want.

Unlike a traditional loan, where you are directly responsible for making payments to the lender, your employer will make the repayments, and you can use the vehicle as part of a salary packaging arrangement. The real upside here is that most of the lease, running costs of the vehicle and fringe benefits tax (FBT) are deducted from your pre-tax salary.

As part of a fully-managed novated lease, your employer is effectively financing the car on your behalf by packaging a salary in a way such that repayments are drawn out of your salary before the ATO receive your income tax. Tax is calculated on your reduced salary, which will usually increase your net disposable income as you are likely to creep into a lower tax bracket. Basically, you are left with more money in your own pockets at the end of the month.

Benefits to drivers.

- Less administration regarding the loan as your employer pays the financier

- You have free reign over how you use the car, be it entirely private use, or a mix

- Greater certainty as far as budgeting

- Tax-free running expenses (GST free motoring costs)

- Maximise your monthly salary or income due to tax treatment

- Fully-managed car ownership

- You can gain a fuel card to manage fuel expenses

Benefits to your Employer.

- Salary sacrificing is simple to implement with one-touch activation and no costs

- Good measure for staff retention and reward

- Reduces the burden on your employees, thus boosting workplace morale

- With every dollar spent on a novated lease arrangement, employers can generate payroll tax savings

So, are novated leases worth it? Totally!

The Fincar team is here to help you with all your financing needs. Contact us today to help arrange your next car or equipment loan.